Phone: (407) 476-

Orlando Foreclosure Attorney

Orlando, Florida 32801

Foreclosure Attorney Michael Stites

-

Speak to an Attorney:

Relax. Phone consultations are always free.

Tell Our Attorneys What Happened

Open M -

Orlando FL, 32801

All initial consultations are completely free and we can contact the same or following business day.

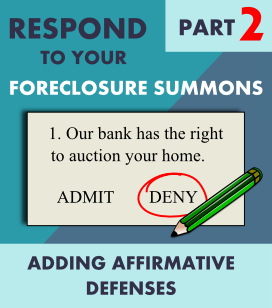

Adding Affirmative Defenses When Responding to a Foreclosure Summons

After you answer each numbered allegation you will have the option to use case law, previous court rulings, and local statues to point out flaws in their foreclosure summons.

Here we reference a previously ruled case to enforce our claim:

Kumar Corp. v Nopal Lines, Ltd, et. al., 462 So.2d 1178, (FLa. 3d DCA 1985). Plaintiff does not have standing to bring this action. Neither the exhibits attached to Plaintiff’s Complaint nor the allegations of the Complaint are sufficient to demonstrate standing. The Plaintiff does not prove that it owns, holds, or has the right to enforce the mortgage.

What we are saying:

Kumar Corp. v Nopal Lines, Ltd was a court case that was ruled in back in 1985. To understand how this helps our case here is a quick background on the ruling:

Seller: Kumar <-

Transport: Norpal <-

Buyer: Nava <-

A US company (Kumar) sold TV sets and parts to a Venezuelan company (Nava) with an agreement that they would be paid after the parts were sold by Nava. They used a transport company (Nopal) to transport the TV sets and parts to Venezuela. During the transport everything was stolen. Kumar had not received payment from Nava and was not carrying insurance for the items being sold.

Kumar sued Nopal (the carrier) to recover the monetary loss of the stolen items. Nopal argued that Kumar did not have standing to sue because there is a Florida statue that says the risk of loss or damage as passed to the buyer (Nava) after items are sold. Kumar fights back that even though this is true, they have two affidavits signed by Nava that ratified and endorsed Kumar’s lawsuit. Nava basically says “yes he can sue on my behalf”.

The case is taken to the Florida Supreme Court and Kumar won because the suit was endorsed by Nava. Since Kumar did not have insurance they were deemed the insurer.

So how does Kumar Corp. V Nopal Lines help our case?

Remember the friend who you owed $20.00 and some other guy came up asking for payment? Let’s say your friend signs a note that says this other guy can take the $20.00 payment on his behalf. You would probably be less worried about giving the new guy the money, right? The same idea works with your mortgage. You are saying since the lender did not include an endorsement from the original lender, they have not proven the debt is actually owed to them. The ruling of Kumar Corp. v Nopal Lines reinforces your argument.

That was just one case ruling example. You need many more to continue bolstering your argument. You will also want to reference Florida statutory laws and the laws of civil procedures with your other affirmative defense arguments.

You can further use this situation to your advantage by further arguing it in your affirmative defenses. (Affirmative defenses should be placed after your answers to the allegations)

We are going to use Example #2 where the lender is unable to produce the original promissory note, you can argue that the plaintiff (the party suing you) does not have any standing to foreclose because the plaintiff is not the real party of interest. This would be a feasible defense if the lender plainly states that they are unable to produce the note.

Remember, with an answer you are simply admitting, denying, or stating you don’t have enough information to admit or deny the allegations. The courts will want your reasoning why you deny an allegation. This is where your affirmative defense comes in.

Drafting an affirmative defense is a bit more complicated because you need to be very specific as to why they are wrong to try and foreclose on you. Typically you will reference previously ruled court cases to help your defense.

AFFIRMATIVE DEFENSES

Defendant, JOHN DOE, hereby respond to the allegations of the Compliant and state affirmatively:

1. PLANTIFF DOES NOT HAVE STANDING PLAINTIFF IS NOT REAL PARTY IN INTEREST:

Plaintiff does not have standing to bring this action. Neither the exhibits attached to Plaintiff’s Complaint nor the allegations of the Complaint are sufficient to demonstrate standing. Standing requires that the party prosecuting the action have a sufficient stake in the outcome and that the party bringing the claim be recognized in the law as being a real party in interest entitled to bring the claim. This entitlement to prosecute a claim in Florida courts rest exclusively in those persons granted by substantive law, the power to enforce the claim. Kumar Corp. v Norpal Lines, Ltd, et. al., 462 So.2d 1178, (FLA. 3d DCA 1985). Plaintiff does not have standing to bring this action. Neither the exhibits attached to Plaintiff’s Complaint nor the allegations of the Complaint are sufficient to demonstrate standing. The Plaintiff does not prove that it owns, holds, or has the right to enforce the mortgage.

Why Are Banks More Willing to Negotiate With Attorneys Compared To Borrowers?

A good foreclosure attorney will find problems with the lender’s foreclosure lawsuit and exploit them to your advantage. This is especially helpful when trying to get leftover debt waived.

Stop Your Foreclosure (before you have been served)

This time should be used to work out a plan with your lender if you are planning on keeping your home.

Can I Defend Against a Foreclosure Without a Lawyer?

Find out why the average homeowner generally does not have the resources available to defend against foreclosure without an attorney.

Determine If Your Home Foreclosure is Eligible to be Defended

Answer 3 quick questions to see if you have a foreclosure defense case.

Above is only one part of the first affirmative defense but I will break down what it is saying piece by piece.

AFFIRMATIVE DEFENSES

Defendant, JOHN DOE, hereby respond to the allegations of the Compliant and state affirmatively:

1. PLANTIFF DOES NOT HAVE STANDING PLAINTIFF IS NOT REAL PARTY IN INTEREST:

Plaintiff does not have standing to bring this action. Neither the exhibits attached to Plaintiff’s Complaint nor the allegations of the Complaint are sufficient to demonstrate standing. Standing requires that the party prosecuting the action have a sufficient stake in the outcome and that the party bringing the claim be recognized in the law as being a real party in interest entitled to bring the claim. This entitlement to prosecute a claim in Florida courts rest exclusively in those persons granted by substantive law, the power to enforce the claim. Kumar Corp. v Norpal Lines, Ltd, et. al., 462 So.2d 1178, (FLA. 3d DCA 1985). Plaintiff does not have standing to bring this action. Neither the exhibits attached to Plaintiff’s Complaint nor the allegations of the Complaint are sufficient to demonstrate standing. The Plaintiff does not prove that it owns, holds, or has the right to enforce the mortgage.

The header:

1. PLANTIFF DOES NOT HAVE STANDING PLAINTIFF IS NOT REAL PARTY IN INTEREST:

What we are saying:

The header is numbered and used to state the first defense and helps keep track of each affirmative defense.

AFFIRMATIVE DEFENSES

Defendant, JOHN DOE, hereby respond to the allegations of the Compliant and state affirmatively:

1. PLANTIFF DOES NOT HAVE STANDING PLAINTIFF IS NOT REAL PARTY IN INTEREST:

Plaintiff does not have standing to bring this action. Neither the exhibits attached to Plaintiff’s Complaint nor the allegations of the Complaint are sufficient to demonstrate standing. Standing requires that the party prosecuting the action have a sufficient stake in the outcome and that the party bringing the claim be recognized in the law as being a real party in interest entitled to bring the claim. This entitlement to prosecute a claim in Florida courts rest exclusively in those persons granted by substantive law, the power to enforce the claim. Kumar Corp. v Norpal Lines, Ltd, et. al., 462 So.2d 1178, (FLA. 3d DCA 1985). Plaintiff does not have standing to bring this action. Neither the exhibits attached to Plaintiff’s Complaint nor the allegations of the Complaint are sufficient to demonstrate standing. The Plaintiff does not prove that it owns, holds, or has the right to enforce the mortgage.

First 2 sentences:

Plaintiff does not have standing to bring this action. Neither the exhibits attached to Plaintiff’s Complaint nor the allegations of the Complaint are sufficient to demonstrate standing.

What we are saying:

The lender should not have the ability to foreclose. The documents attached to the back of the summons (a copy of the note and mortgage) are NOT enough to prove the lender can foreclose on you.

AFFIRMATIVE DEFENSES

Defendant, JOHN DOE, hereby respond to the allegations of the Compliant and state affirmatively:

1. PLANTIFF DOES NOT HAVE STANDING PLAINTIFF IS NOT REAL PARTY IN INTEREST:

Plaintiff does not have standing to bring this action. Neither the exhibits attached to Plaintiff’s Complaint nor the allegations of the Complaint are sufficient to demonstrate standing. Standing requires that the party prosecuting the action have a sufficient stake in the outcome and that the party bringing the claim be recognized in the law as being a real party in interest entitled to bring the claim. This entitlement to prosecute a claim in Florida courts rest exclusively in those persons granted by substantive law, the power to enforce the claim. Kumar Corp. v Norpal Lines, Ltd, et. al., 462 So.2d 1178, (FLA. 3d DCA 1985). Plaintiff does not have standing to bring this action. Neither the exhibits attached to Plaintiff’s Complaint nor the allegations of the Complaint are sufficient to demonstrate standing. The Plaintiff does not prove that it owns, holds, or has the right to enforce the mortgage.

We go on to define what “standing” is:

Standing requires that the party prosecuting the action have a sufficient stake in the outcome and that the party bringing the claim be recognized in the law as being a real party in interest entitled to bring the claim. This entitlement to prosecute a claim in Florida courts rest exclusively in those persons granted by substantive law, the power to enforce the claim.

What we are saying:

Standing is important because it is what the lender should have in order to foreclose. They should have an actual claim to the home they are trying to foreclose on.

Real Life Example:

Lets say your friend lets you borrow $20.00. Your friend has a standing claim to the $20.00 that you owe him, meaning your friend is owed the money by you.

Imagine then some random person you don’t know walks up to you demanding the $20.00 that you owe your friend. Where did this person get a standing claim for the $20.00 you owe your friend? You would probably want this random person to show you solid evidence that you owe them the $20.00 instead of your friend. We are applying the same concept to this affirmative defense.

Affirmative Defenses Overview

Created by Attorney Michael Stites & contributing editor Jared Speck

Referencing case law and previously ruled cases is another important part when creating your affirmative defenses. It allows you to create reference points to when you make claims. Think of it like referencing a source when you write an essay. If you write that 50% of all homes in Florida are in foreclosure, readers would want to know where you got that number from.

AFFIRMATIVE DEFENSES

Defendant, JOHN DOE, hereby respond to the allegations of the Compliant and state affirmatively:

1. PLANTIFF DOES NOT HAVE STANDING PLAINTIFF IS NOT REAL PARTY IN INTEREST:

Plaintiff does not have standing to bring this action. Neither the exhibits attached to Plaintiff’s Complaint nor the allegations of the Complaint are sufficient to demonstrate standing. Standing requires that the party prosecuting the action have a sufficient stake in the outcome and that the party bringing the claim be recognized in the law as being a real party in interest entitled to bring the claim. This entitlement to prosecute a claim in Florida courts rest exclusively in those persons granted by substantive law, the power to enforce the claim. Kumar Corp. v Norpal Lines, Ltd, et. al., 462 So.2d 1178, (FLA. 3d DCA 1985). Plaintiff does not have standing to bring this action. Neither the exhibits attached to Plaintiff’s Complaint nor the allegations of the Complaint are sufficient to demonstrate standing. The Plaintiff does not prove that it owns, holds, or has the right to enforce the mortgage.

It is a long read but fairly self explanatory. Even most of the case references have a quick summary next to them.

This is just a single argument for this affirmative defense. There were a total of 12 affirmative defenses made against the plaintiffs claim.

The Mortgage clearly states that, “MERS is the mortgagee.” With mortgagee being synonymous with lender, this statement acts to establish MERS as the original lender, rendering them a necessary and indispensable party to this action. An indispensable party is one whose interest in the controversy makes it impossible to completely adjudicate the matter without affecting either that party’s interest or the interests of another party in the action. Hertz Corp.v. Piccolo, 453 So. 2d 12, 14 n.3 (FLa. 1984) (describing indispensable parties as ones so essential to a suit that no final decision can be rendered without their joinder); Bastida v. Batchelor, 418 So. 2d 297, 299 (Fla. 3d DCA 1982)(“An indispensable party [is] one without whom the rights of others cannot be determined.”). As we stated in Oakland Properties Corp. v. Hogan, 117 So. 846, 848 (Fla. 1928) (quoting Indian River Mfg. Co. v. Wooten, 37 So. 731, 731 (Fla. 1904) (syllabus).

The general rule in equity is that all persons materially interested, either legally or beneficial, in the subject-

The clear language in the mortgage names MERS as a mortgagee; this would, at the very least, create and ambiguity pertaining to a material fact upon which Plaintiff’s claim is based. Under contractual law, any ambiguities shall be construed against the drafter, which in this case would be an interpretation against the Plaintiff and in favor of the defendant. Plaintiff should have included a count to reform the mortgage, to help explain these material ambiguities, which would have in turn, created a more definite statement.

To begin, there is nothing attached to the Complaint which establishes that Plaintiff, WELLS BANKER, AS SUCCESSOR TRUSTEE UNDER SUPERSTAR MORTGAGE FUNDING TRUST, SERIES 2010-

1. PLANTIFF DOES NOT HAVE STANDING PLAINTIFF IS NOT REAL PARTY IN INTEREST:

2. DISMISSAL OF COUNT TO REESTABLISH PROMISSORY NOTE

3. FAILURE TO FILE NON-

4. FAILURE TO SATISFY CONDITIONS PRECEDENT

5. FAILURE TO COMPLY WITH APPLICABLE HUD SINGLE FAMILY DEFAULT LOAN SERVICES REQUIREMENTS/FAILURE TO COMPLY WITH CONDITIONS PRECEDENT:

6. PRIOR BREACH OF CONTRACT

7. UNCLEAN HANDS/ESTOPPEL

8. ILLEGAL CHARGES ADDED TO BALANCE

9. FAILURE OF GOOD FAITH AND FAIR DEALING: UNFAIR AND UNACCEPTABLE LOAN SERVICING

10. ATTORNEYS’ FEES NOT PERMISSIBLE

11. FAILURE TO STATE A CAUSE OF ACTION

12. DEMAND FOR MEDIATION

Each one of the affirmative defense will have a lengthy explanation as to what is wrong with the foreclosure summons and why. When you hire a foreclosure attorney they usually explain that there is a bunch of paper work that needs to be drafted and filed immediately. This is some of the paperwork they are referring to.

Here is the outline of the 12 other affirmative defenses that were raised:

Affirmative Defense Example #1

One affirmative defense we can use for when the lender lost the note (from our second foreclosure example) may look like this:

Affirmative Defense Example Breakdown

Referencing Previously Ruled Court Cases:

The Rest of the First Affirmative Defense:

The 12 Other Affirmative Defenses Raised

Related Posts:

Related Topics:

Consults are free, even if you are asking general foreclosure questions.

Relax. Phone consultations are always free. It can’t hurt to talk.

Speak to an Attorney: